Are you a member of the Splunk Community?

- Find Answers

- :

- Using Splunk

- :

- Splunk Search

- :

- Finding the ratio between fields in different even...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark Topic

- Subscribe to Topic

- Mute Topic

- Printer Friendly Page

- Mark as New

- Bookmark Message

- Subscribe to Message

- Mute Message

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

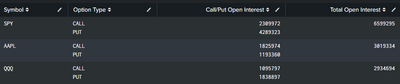

I have the a search (picture below) which is calculating the open option interest on several ticker symbols. I was able to figure out how to calculate the sum of the "Call/Put Open Interest" field for each ticker, I can't figure out how to calculate the ratio between them. For example the Apple (AAPL) symbol should have a field with value 1.53. This was found by manually dividing the call open interest (1825974) by the put open interest (1193360). How can I create a new field that calculates this for me?

My search is:

index=raw

| eventstats max(_time) as maxtime

| where _time=maxtime

| stats sum(open_interest) as OI by ul_symbol, put_call

| stats list(put_call) as "Option Type" , list(OI) as "Call/Put Open Interest", sum(OI) as "Total Open Interest" by ul_symbol

| sort -"Total Open Interest"

| rename ul_symbol as "Symbol"And an example of an event is:

{ [-]

ask: 8.9

bid: 6.5

delta: -0.46

dte: 42

expiration_date: Nov 6

gamma: 0.02

high_price: 9.85

last: 7.85

low_price: 7.75

net_change: -2.59

open_interest: 6

percent_change: -24.83

put_call: PUT

rho: -0.07

strike: 112

symbol: AAPL_110620P112

theta: -0.091

time_value: 7.85

ul_symbol: AAPL

vega: 0.153

volume: 55

}I'm definitely new to all this. Appreciate the help!

- Mark as New

- Bookmark Message

- Subscribe to Message

- Mute Message

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not clear how you are differentiating between call and put. However, from your existing search, you may try

Your search

|eval call=mvindex('Call/Put Open Interest',0),put=mvindex('Call/Put Open Interest',1)|eval ratio=call/putIf its possible to identify call and put from the event, you may do that in the stats as well

e.g.

Your search

| stats list(put_call) as "Option Type" , list(OI) as "Call/Put Open Interest", sum(OI) as "Total Open Interest",

first(eval(if(<condition for call>),OI,null()) ) as call, first(eval(if(<condition for put>),OI,null()) ) as put by ul_symbol

|eval ratio=call/put

What goes around comes around. If it helps, hit it with Karma 🙂

- Mark as New

- Bookmark Message

- Subscribe to Message

- Mute Message

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not clear how you are differentiating between call and put. However, from your existing search, you may try

Your search

|eval call=mvindex('Call/Put Open Interest',0),put=mvindex('Call/Put Open Interest',1)|eval ratio=call/putIf its possible to identify call and put from the event, you may do that in the stats as well

e.g.

Your search

| stats list(put_call) as "Option Type" , list(OI) as "Call/Put Open Interest", sum(OI) as "Total Open Interest",

first(eval(if(<condition for call>),OI,null()) ) as call, first(eval(if(<condition for put>),OI,null()) ) as put by ul_symbol

|eval ratio=call/put

What goes around comes around. If it helps, hit it with Karma 🙂

- Mark as New

- Bookmark Message

- Subscribe to Message

- Mute Message

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

That did the trick! I read up on mvindex yesterday but it didn't click with me that it was what I needed. I've got a better understanding of it now. Thank you!