- Find Answers

- :

- Premium Solutions

- :

- Splunk Enterprise Security

- :

- Risk-Based Alerting FAQs

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark Topic

- Subscribe to Topic

- Mute Topic

- Printer Friendly Page

- Mark as New

- Bookmark Message

- Subscribe to Message

- Mute Message

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Risk-Based Alerting FAQs

For new RBA users, here are some frequently asked questions to help you better get started with the product.

1. What is RBA(Risk-based Alerting)?

Risk-Based Alerting (RBA) is Splunk's method to aggregate low-fidelity security events as interesting observations tagged with security metadata to create high-fidelity, low-volume alerts. When Splunk customers use RBA, they see a 50% to 90% reduction in alerting volume, while the remaining alerts are higher fidelity, provide more context for analysis, and are more indicative of true security issues.

2. Why RBA?

With Splunk RBA, you can:

- Improve the detection of sophisticated threats including low and slow attacks often missed by traditional SIEM products.

- Seamlessly align with leading cyber security frameworks such as MITRE ATT&CK, Kill Chain, CIS 20, & NIST.

- Scale analyst resources to optimize SOC productivity and efficiency

3. Fundamental terminology for RBA

- Risk Analysis Adaptive Response Action: Risk Analysis Adaptive Response Action is the actual response action that gets triggered either instead of or in addition to a notable event response action when a risk rule matches. It adds risk scores and security metadata to events that are stored in the risk index as risk events for every risk object.

- Notable Events: An event generated by a correlation search as an alert. A notable event includes custom metadata fields to assist in the investigation of the alert conditions and to track event remediation.

- Asset and Identity Framework: The Asset and Identity framework performs asset and identity correlation for fields that might be present in an event set returned by a search. The Asset and Identity framework relies on lookups and configurations managed by the Enterprise Security administrator.

- Common Information Model(CIM): The Splunk Common Information Model (CIM) is a shared semantic model focused on extracting value from data. The CIM is implemented as an add-on that contains a collection of data models, documentation, and tools that support the consistent, normalized treatment of data for maximum efficiency at search time.

- Risk Analysis Framework: The Risk Analysis framework provides the ability to identify actions that raise the risk profile of individuals or assets. The framework also accumulates that risk to allow identification of people or devices that perform an unusual amount of risky activities.

- Risk Event Timeline: Risk Event Timeline is a popup visualization that can drill down and analyze the correlation of the risk events with their associated risk score.

- Risk Score: A risk score is a single metric that shows the relative risk of an asset or identity such as a device or a user in your network environment over time.

- Risk Rule: A Risk Rule is a narrowly defined correlation search run against raw events to observe potentially malicious activity. A Risk Rule contains three components: search logic (Search Processing Language), Risk Annotations, and the Risk Analysis Adaptive Response action to generate risk events. All risk events are written to the Risk Index.

- Risk Incident Rule: A risk incident rule reviews the events in the risk index for anomalous events and threat activities and uses an aggregation of events impacting a single risk object, which can be an asset or identity, to generate risk notables in Splunk Enterprise Security.

4. What are the common use cases of RBA?

The most common use case for RBA is detection of malicious compromise.

However the methodology can be utilized in many other ways, some of them include: machine learning, insider risk, fraud.

- Machine learning: Risk-Based Alerting (RBA) is key in elevating Machine Learning from hype to practice, filtering through data noise and spotlighting actionable insights by combining domain knowledge with smart data processing.

- Insider risk: RBA streamlines the process of leveraging the MITRE ATT&CK framework by homing in on the critical data sources and use cases essential for a robust insider risk detection program, resulting in a more focused approach with significantly reduced development time for a mature program while providing high value insights and the capability to alert on activity over large timeframes.

- Fraud: The Splunk App for Fraud Analytics, driven by the RBA framework, sharpens fraud detection and prevention, particularly for Account Takeover and new account activities. It streamlines the creation of risk rules from its investigative insights, promising significant operational gains post-integration with Splunk ES.

5. What are the prerequisites for using RBA?

To use RBA efficiently, you need to have Splunk Enterprise Security 6.4+ (ES) installed.

6. What is the relationship between Enterprise Security and RBA?

Enterprise Security(ES) is a SIEM solution that provides a set of out of the box frameworks for a successful security operation program. RBA is the framework to surface high-fidelity, low-volume alerts from subtle or noisy behaviors, and works in conjunction with the Search, Notable Event, Asset and Identity, and Threat Intel frameworks.

7. How can I implement RBA successfully?

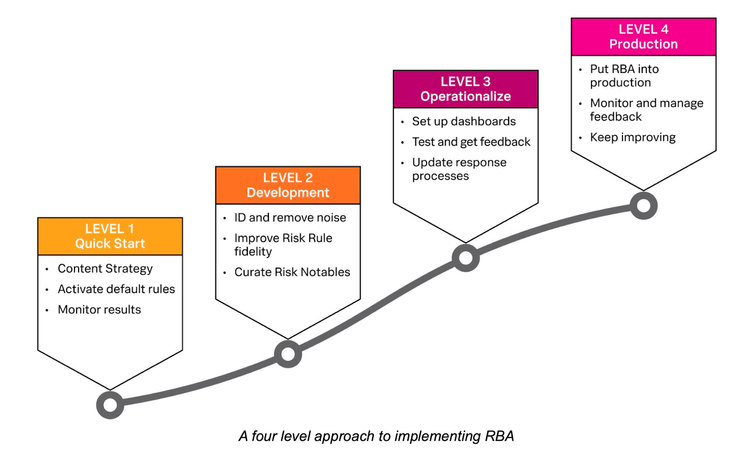

Follow the four level approach to implementing RBA

Check each step in detail using the RBA Essential Guide.

8. What RBA content should I start with?

- Leverage the MITRE ATT&CK framework mapped against your data sources if you're at the start of your journey OR leverage your existing alert landscape and focus on noisy alerts closed with no action.

- Consider ingesting a data source like EDR, DLP, or IDS with many of its own signatures and applying different risk amounts by severity.

- Try and paint a picture with a collection of content.

- Review fingerprints from successful red team intrusions or create a purple team exercise.

- If engaging PS, stick to one use case per day.

- Don't try to boil the ocean - stick to crawl, walk, run approach. It will ramp up as the foundations are set in place.

9. Where do I start and how often do I review the detections?

- You need events in the risk index to drive risk alerts. Start with at least 5-10 detections / rules (for smaller companies) - utilize the Essential Guide for step by step instructions

- Make sure they tell a story - spanning a breadth of ATT&CK phases

- Ensure you have a breadth of risk scores; if your threshold is 100, you want variation so that a high (75) and a low (25), or two mediums (50), or four lows (25) could all bubble up to something interesting.

- Discuss risk notables with your internal RBA committee on a weekly basis, and maybe monthly with leadership to discuss trends

NOTE: Don't be afraid to set the risk score to zero. you have to do this in SPL: | eval risk_score = “0”

10. How to calculate risk scores in RBA?

The Splunk Threat Research Team utilizes a combination of Impact, or potential effectiveness of the attack if this was observed, and Confidence as to how likely this is a malicious event. The confidence in every environment can vary, so it is important to test detections on a large timeframe and get an idea of how common this observation is in your environment and score appropriately. You may want to score an observation differently based on a signature, business unit, or anything you find happening too often, so you can also set the risk_score field in your SPL. There are examples of this in the Essential Guide as well as on the RBA Github.

11. What are the best practices for setting and adjusting risk scores as the implementation improves?

It’s important to keep your threshold constant and tune your risk scores around the threshold. Risk scores are meant to be dynamic as you find what is or isn’t relevant in the risk notables that surpass the threshold from your events. Often it makes sense to lower the risk based off of attributes about a risk object or other interesting fields indicating non-malicious, regular business traffic in your detections by declaring the risk_score field in your SPL. As you advance, you can try making custom risk incident rules that look at risk events over larger amounts of time and play with increasing the threshold.

12. What are the primary challenges in the RBA implementation process?

- Buy-in from both technical and business (economic buyer / leadership) sides

- Time invested in initial development and continued documentation

- Familiarity with SPL (commands of value: rex, eval, foreach, lookup, makeresults, autoregress)

- Tuning of the risk scoring

- Getting the SOC involved (they are the ones intimately involved with all the noise on a daily basis)

- A&I is ideal, but it doesn't have to be perfect. A train wreck is ok.

- RBA is a JOURNEY, not a one-and-done deal.

13. How can I simulate events in the risk index for testing RBA?

Splunk ATT&CK Range is the perfect fit for this:

There are also open source solutions like Atomic Red Team which is also available on Github.

14. What are the most helpful self-service RBA resources?

- Splunk Lantern RBA Prescriptive adoption motion

- NEW Standalone RBA Manual

- The essential guide to Risk-Based Alerting: Comprehensive implementation guide from start to finish

- The RBA Community hosts a community Slack, regular office hours, and common resources to help with R...